Life comes with a multitude of lessons – but perhaps some of the most memorable and long-standing are financial. Who can forget the taste of two-minute noodles for the last week of the month before pay-day because you blew your budget, or that new car smell when years of saving come together and you drive off in your dream car?

Budgeting, saving and looking after the pennies so that the pounds can take care of themselves isn’t easy, and every single person will have at least one story about having to learn the value of money the hard way. But these lessons are invaluable and can help prevent others from making the same mistakes, particularly when it comes to the foundations of financial success.

This includes making the psychological shift necessary to foster a saving mindset and unlearning certain behaviours that are actively preventing you from improving your finances. “Important elements of the ability to achieve this are understanding financial concepts like your credit score, compound interest, as well as exploring ways to build wealth such as through a side hustle,” says Poloka Thomas, Financial Accountant at Momentum. Poloka is passionate about sharing her own journey through financial literacy to enable others coming after her to avoid making the same mistakes she made.

Navigating this can be tricky, but Thomas has five top tips to help:

- The ins-and-outs of saving: the power of delayed gratification

“Yes, it takes long to save up for anything, but the financial benefits are so much better than having the stress of figuring out how to pay back for things you couldn’t afford to begin with

Learning this restraint and embracing the principle of delayed gratification to improve financial wellbeing through saving requires a psychological shift. The shift, says Thomas, means learning the difference between what we qualify for and what we can actually afford.

My favourite story to illustrate this is of two men:

- Ronald James Read (October 23, 1921 – June 2, 2014) was an American philanthropist, investor, janitor, and gas station attendant.

- He enlisted in the United States Army during World War II. Upon an honorable discharge from the military in 1945, Read worked as a gas station attendant and mechanic for about 25 years. Read retired for one year and then took a part-time janitor job at J. C. Penney where he worked for 17 years, until 1997.

- Read died in 2014. He received media coverage in numerous newspapers and magazines after bequeathing US$1.2 million to Brooks Memorial Library and $4.8 million to Brattleboro Memorial Hospital. Read amassed a fortune of almost $8 million by investing in dividend-producing stocks, living frugally, and being a buy and hold investor in a diversified portfolio of stocks.

Versus

- Richard Fuscone was the opposite of Ronald Read: educated at Harvard and University of Chicago, and rising through the ranks of high finance, Fuscone became Executive Chairman of the Americas at Merrill Lynch. He became so successful in the investment industry that he retired in his 40s to “pursue personal and charitable interests”.

- In the mid-2000s, Fuscone borrowed heavily to expand an 18,000-square foot home in Greenwich, Connecticut that had 11 bathrooms, two elevators, two pools, seven garages, and cost more than $90,000 a month to maintain.

- But Fuscone filed for bankruptcy in 2010 after the 2008 financial crisis hit and high levels of debt and a lack of liquid assets saw his fortunes dwindle.

The two tales clearly demonstrate that just because you may be uneducated, it doesn’t mean you will die poor – nor does being educated mean that you will make sound financial decisions.

- Being intentional about learning how money works

Resisting the temptation to buy what we know we can’t afford is likely one of the hardest lessons to learn – and typically takes a few tries to get right. This is because it requires unlearning certain behaviours that hold many of us back, with not being intentional about learning about how money works topping the list.

“Most people find it easy to open store accounts, get a cellphone contract, or open a credit card because these are mainly transactions that they are familiar with and it is a familiarity created by exposure; however, very few are willing to open a trading account, share investments and other savings products because they are largely unfamiliar with these and think they can’t afford them,” she says.

Her advice: be intentional about learning, because you are your own greatest investment.

- Learning about credit scores and why they matter

“A credit score is a rating of your previous responsibility with credit,” Thomas explains. A credit score can impact many financial transactions, including mortgages, credit cards, buying a car, private loans and getting employed.

What affects people’s credit scores negatively is: having too much credit, paying bills too late, being backlisted or having judgements against your name. “Because of the wide-ranging and serious consequences of a bad credit score, it is in everyone’s best interest to learn theirs and strive to improve it,” says Thomas.

People can check individual credit scores using entities like TransUnion and Clear Score, and Clear Score even offers coaching on how to improve it. Other ways to improve it include using credit wisely and only when necessary, paying bills on time, and paying off outstanding debts.

- A lesson in compound interest

“Long story short, ‘He who understands it, earns it … he who doesn’t … pays it.’”, says Thomas. “Take this example: two people save money. One saves R500 for 30 years, and the other saves R1000 for 20 years. But surprisingly it is not the person who saved the biggest amount who walks away with the most savings. That is what compound interest does – because earning interest every year for a longer period of time yields more money.”

Her top tip: when it comes to saving, longer is better, so do not wait to start saving more later – rather start small and let time help you along.

- When interest alone isn’t enough, invest in a side hustle

Side hustles help improve cashflow and mean people can afford more. But many fail to fully reap these benefits because of overthinking and a failure to act. “It is impossible to edit a blank page, so just get started,” she says.

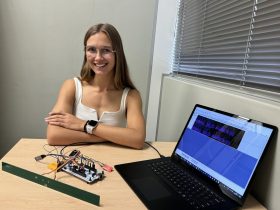

Her own experience taught her this, helping her redefine her strategy when needed and teaching her valuable lessons about how to structure her current project: building a financial literacy application to make learning easier, fun and more accessible to everyone.

Thomas’ advice about setting up a side hustle is simple. “You don’t need funding, what you need is your first client – if you can find one person willing to use or buy your product, you are in the game and the money will follow.”

Leave a Reply